Max Contribution To Hsa 2025. Your contribution limit increases by $1,000 if you’re 55 or older. The irs has just announced updated 2025 fsa.

For family coverage, the maximum annual hsa. The maximum contribution limits for health savings accounts (hsas) have been updated.

2025 HSA Max Contribution Limit Update and Prediction YouTube, For 2025, the limit will increase by. The irs announced that 2025 hsa contribution limits will increase to $4,300 for.

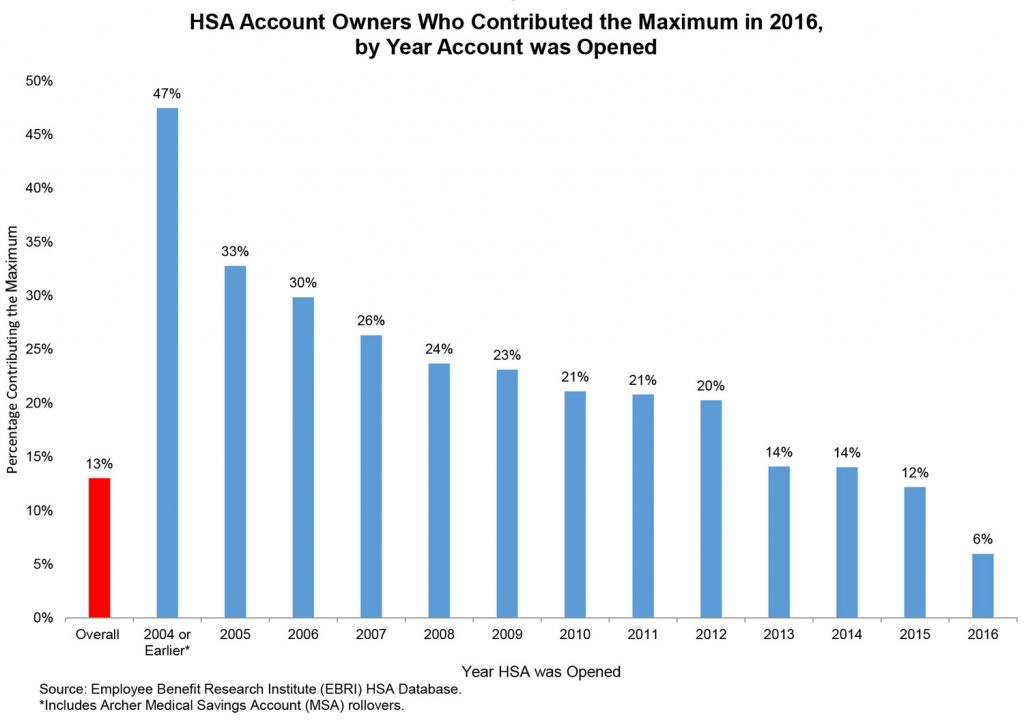

Employees Should Max Out Their HSA Contributions Wellable, The maximum contribution limits for health savings accounts (hsas) have been updated. For family coverage, the maximum annual hsa.

How to Calculate Max HSA Contributions Lively, For family coverage, the maximum annual hsa. Your contribution limit increases by $1,000 if you’re 55 or older.

HSA Contribution Limits for 2025 and 2025, For family coverage, the maximum annual hsa. The adjusted contribution limits for hsas take effect on jan.

Is Raising the Maximum for HSA Contributions Necessary? ThinkAdvisor, The irs has just announced updated 2025 fsa. For 2025, the maximum contribution level rises to $4,300 for individuals and to $8,550 for families.

Maximum Hsa Contribution 2025 Over 50 Druci, The 2025 hsa contribution limit for individual coverage increases by $150 to $4,300. 2025 maximum hsa contribution limits.

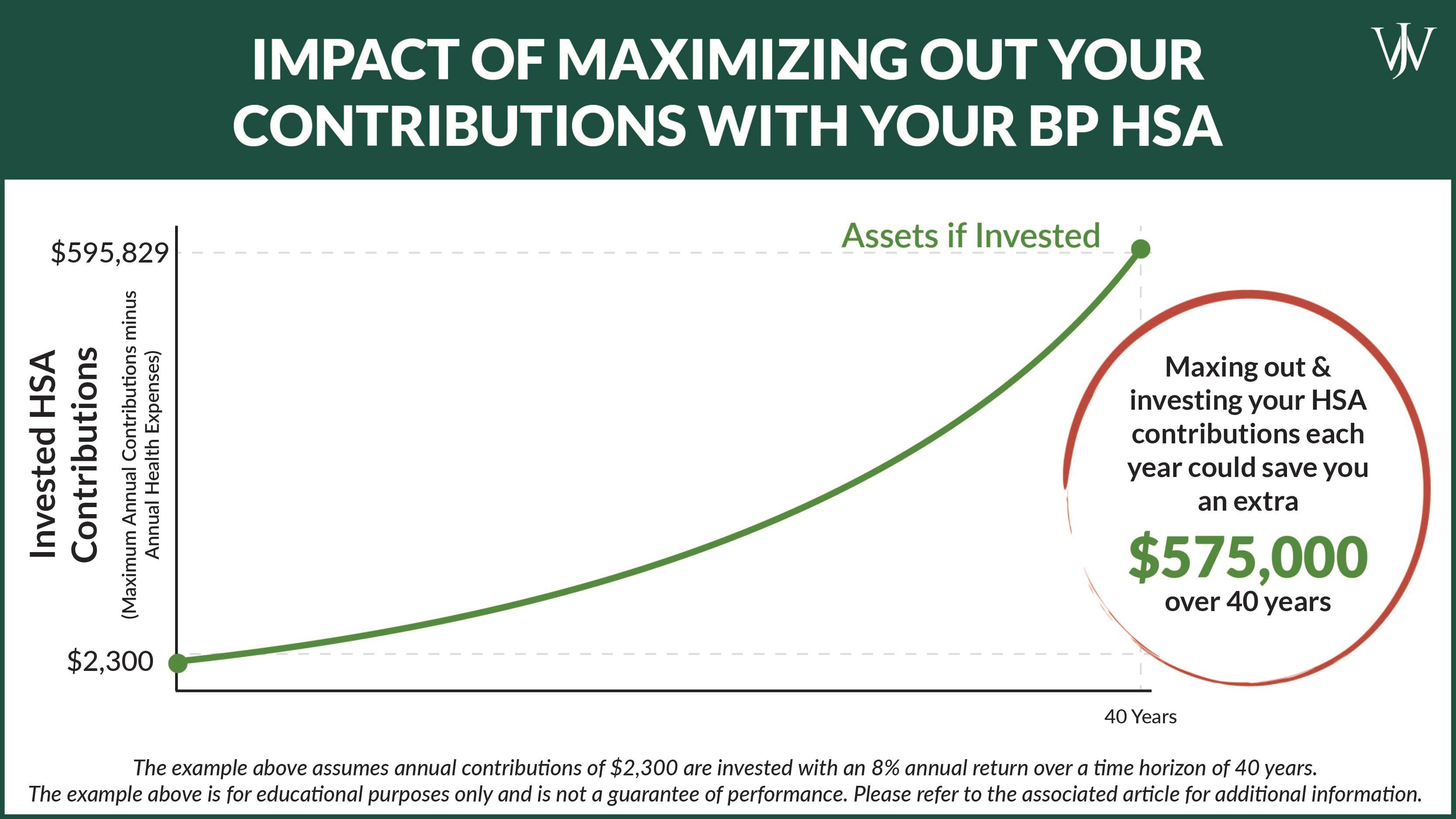

BP HSA Tax Benefits & Investment Strategies To Consider in Open Enrollment, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. Your contribution limit increases by $1,000 if you’re 55 or older.

Savings Boost IRS Raises HSA Contribution Limits for 2025, For family coverage, the hsa. Your contribution limit increases by $1,000 if you’re 55 or older.

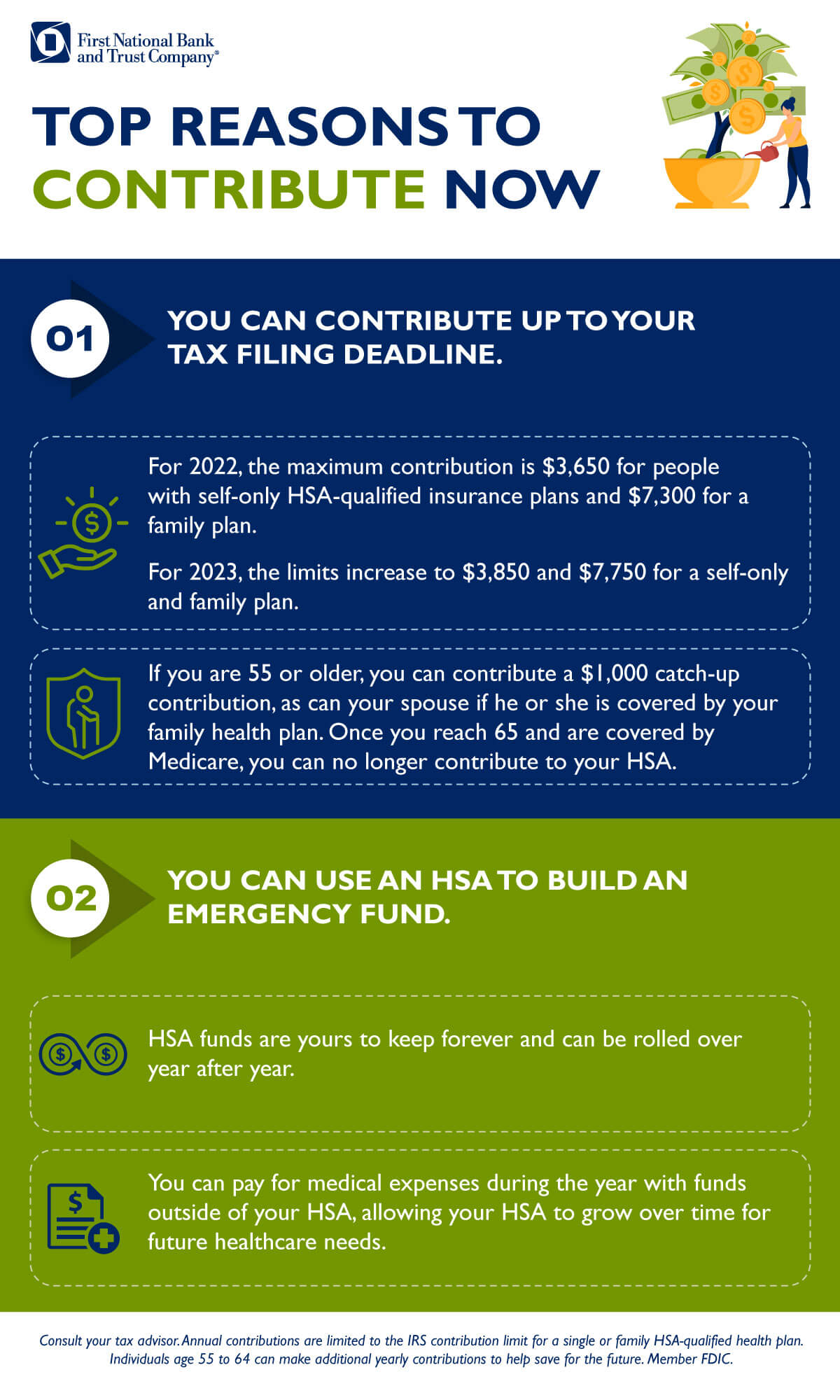

HSA Two Great Reasons To Contribute Right Now FNBT Southern WI, For family coverage, the hsa. Your contribution limit increases by $1,000 if you’re 55 or older.

Balancing 401(k) and HSA Pretax Contributions First Citizens, For family coverage, the maximum annual hsa. The irs announced that 2025 hsa contribution limits will increase to $4,300 for.